Individual transactions which result in income and expenses being recorded will ultimately result in a profit or loss for the period. The term capital includes the capital introduced by the business owner plus or minus any profits or losses made by the business. Profits retained in the business will increase capital and losses will decrease capital. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

What Is Shareholders’ Equity in the Accounting Equation?

- The purpose of this article is to consider the fundamentals of the accounting equation and to demonstrate how it works when applied to various transactions.

- So, let’s take a look at every element of the accounting equation.

- Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

- During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash.

- Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan.

- All of our content is based on objective analysis, and the opinions are our own.

A financial professional will be in touch to help you shortly. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Expanded Accounting Equation Formula

The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000). Drawings are amounts taken out of the business by the business owner. In other words, all assets initially come from liabilities and owners’ contributions. Before taking this lesson, be sure to be familiar with the accounting elements. To learn more about the income statement, see Income Statement Outline. Receivables arise when a company provides a service or sells a product to someone on credit.

Company

It offers a quick, no-frills answer to keeping your assets versus liabilities in balance. On 5 January, Sam purchases merchandise for $20,000 retail accounting software on credit. As a result of the transaction, an asset in the form of merchandise increases, leading to an increase in the total assets.

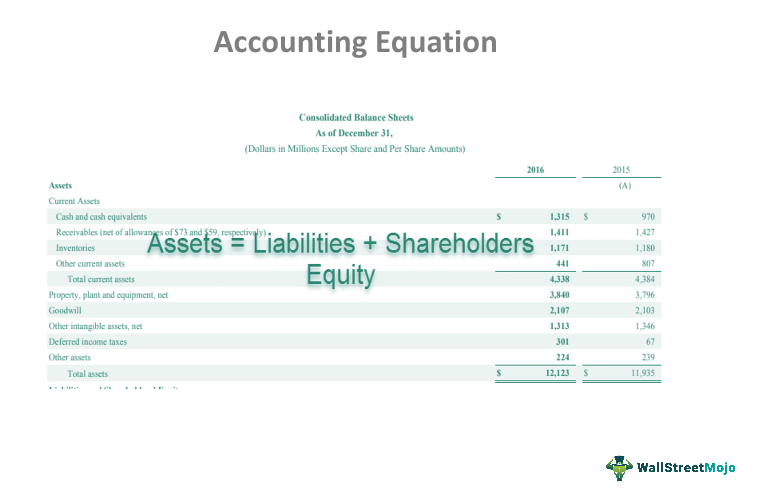

In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity. The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time.

Understanding the Components of the Accounting Equation

In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side). In other words, the accounting equation will always be “in balance”. This equation should be supported by the information on a company’s balance sheet. The Accounting Equation is the foundation of double-entry accounting because it displays that all assets are financed by borrowing money or paying with the money of the business’s shareholders. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

The difference between the $400 income and $250 cost of sales represents a profit of $150. The inventory (asset) will decrease by $250 and a cost of sale (expense) will be recorded. (Note that, as above, the adjustment to the inventory and cost of sales figures may be made at the year-end through an adjustment to the closing stock but has been illustrated below for completeness). As business transactions take place, the values of the accounting elements change.

If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for. The accounting equation shows the amount of resources available to a business on the left side (Assets) and those who have a claim on those resources on the right side (Liabilities + Equity). However, due to the fact that accounting is kept on a historical basis, the equity is typically not the net worth of the organization.

Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights. However, equity can also be thought of as investments into the company either by founders, owners, public shareholders, or by customers buying products leading to higher revenue. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Most sole proprietors aren’t going to know the knowledge or understanding of how to break down the equity sections (OC, OD, R, and E) like this unless they have a finance background. Still, you’ll likely see this equation pop up time and time again.

If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. Assets pertain to the things that the business owns that have monetary value. Examples of assets include, but are not limited to, cash, equipment, and accounts receivable. This refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted. Accountants and members of a company’s financial team are the primary users of the accounting equation. Understanding how to use the formula is a crucial skill for accountants because it’s a quick way to check the accuracy of transaction records .