You will need to adjust the accounts receivable balance on the balance sheet downwards to reflect the higher amount of uncollectible accounts. And, having a lot of bad debts drives down the amount of revenue your business should have. By predicting the amount of accounts receivables customers won’t pay, you can anticipate your losses from bad debts. The accounts receivable method is considerably more sophisticated and takes advantage of the aging of receivables to provide better estimates of the allowance for bad debts.

Methods for estimating allowance for doubtful accounts

This type of account is a contra asset that reduces the amount of the gross accounts receivable account. The sales method applies a flat percentage to the total dollar amount of sales for the period. For example, based on previous experience, a company may expect that 3% of net sales are not collectible. If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense.

Real-time credit health with AI-based credit scoring models

There are also downsides to having too small or too large of an allowance for doubtful accounts. Trade credit insurance is one tool to help reduce the overall impact of bad debts and secure the accounts receivable asset, thereby improving the accuracy of cash flow and P&L forecasting. An allowance for bad debt is a valuation account used to estimate the amount of a firm’s receivables that may ultimately be uncollectible. When a borrower defaults on a loan, the allowance for bad debt account and the loan receivable balance are both reduced for the book value of the loan. The remaining amount from the bad debt expense account (the portion of the $10,000 that is never paid) will show up on a company’s income statement. This is where a company will calculate the allowance for doubtful accounts based on defaults in the past.

Accounting for the Allowance for Doubtful Accounts

- This will help present a more realistic picture of the accounts receivable amounts you expect to collect, versus what goes under the allowance for doubtful accounts.

- Say you have a total of $70,000 in accounts receivable, your allowance for doubtful accounts would be $2,100 ($70,000 X 3%).

- This is done by using one of the estimation methods above to predict what proportion of accounts receivable will go uncollected.

The specific identification method is another technique, albeit more labor-intensive. This method involves a detailed review of each outstanding receivable to assess its collectibility. Factors such as the customer’s payment history, current financial condition, and any recent communication regarding payment difficulties are considered. While this method can be time-consuming, it offers a highly accurate estimate of doubtful accounts, particularly for businesses with a smaller number of high-value receivables. Let’s assume that a company has a debit balance in Accounts Receivable of $120,500 as a result of having sold goods on credit. Through the use of the aging method, the company sees that $18,000 of the receivables are 100 days past due.

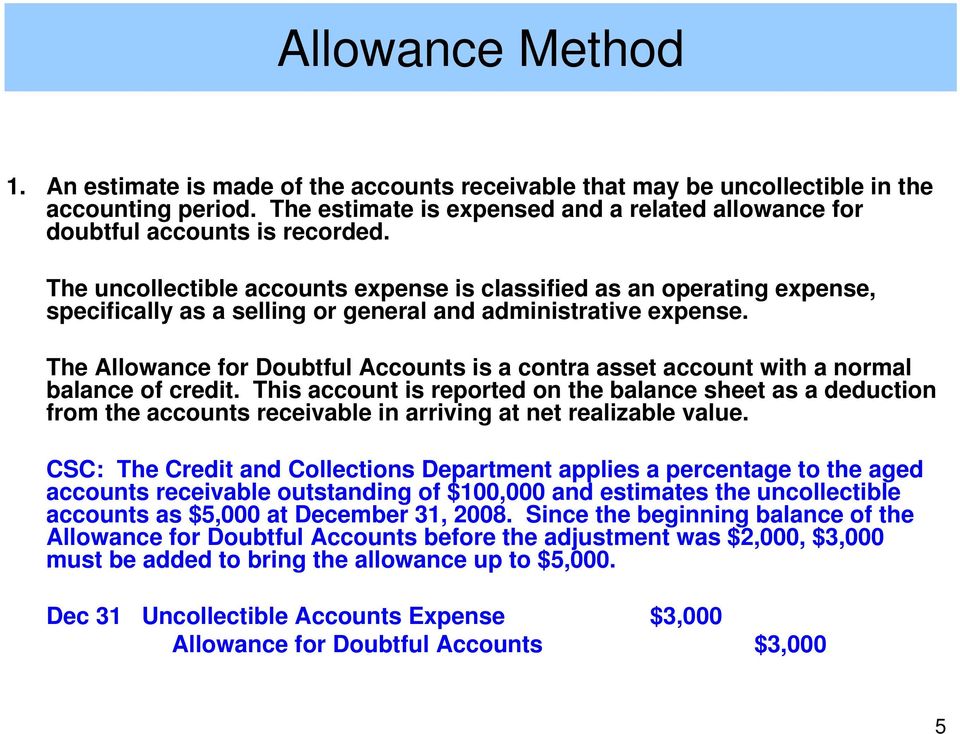

Allowance for Doubtful Accounts Journal Entry

After a certain period of time going uncollected, a doubtful account can become a bad debt, which is ultimately a cost that’s absorbed by your business. Then all of the category estimates are added together to get one total estimated uncollectible balance for the period. The entry for bad debt would be as follows, if there was no carryover balance from the prior period. The Allowance for Doubtful Accounts is a balance sheet contra asset account that reduces the reported amount of accounts receivable. In particular, your allowance for doubtful accounts includes past-due invoices that your business does not expect to collect before the end of the accounting period.

In this example, the company often assigns a percentage to each classification of debt. Then, it aggregates all receivables in each grouping, calculates each group by the percentage, and records an allowance equal to the aggregate of all products. Allowance for Doubtful Accounts decreases (debit) and Accounts Receivable for the specific customer also decreases (credit). Allowance for doubtful accounts decreases because the bad debt amount is no longer unclear. Accounts receivable decreases because there is an assumption that no debt will be collected on the identified customer’s account.

The allowance for doubtful accounts is a contra-asset account that reduces the total accounts receivable reported on the balance sheet. This adjustment is necessary to reflect the realistic collectible amount, ensuring that the financial statements are not overly optimistic. The process begins with identifying the accounts that are likely to become uncollectible. This involves analyzing historical data, customer creditworthiness, and current economic conditions. The Allowance for Doubtful Accounts is a vital accounting tool for businesses offering credit. By estimating potential bad debts, companies can prepare for financial uncertainties and ensure accurate financial reporting.

This could range from 2% for some companies to 5% for others, based on past performance. By monitoring customer payment behavior, we can provide insights into customer delinquency trends to help you determine which customers are at greater risk of defaulting on their payments. This, in turn, will allow you to adjust your allowance for doubtful accounts accordingly.

Also, note that when writing off the specific account, no income statement accounts are used. This is because the expense was already taken when creating or adjusting the allowance. If a company has a history of recording or tracking bad debt, it can use the historical percentage of bad debt if it feels that historical measurement relates to its current debt. is allowance for doubtful accounts a permanent account For example, a company may know that its 10-year average of bad debt is 2.4%. Therefore, it can assign this fixed percentage to its total accounts receivable balance since more often than not, it will approximately be close to this amount. The company must be aware of outliers or special circumstances that may have unfairly impacted that 2.4% calculation.

It is important to understand that the allowance doesn’t protect against slow payments or lessen the impact of bad debt losses. As such, effective credit management and debt collection procedures should be a critical part of the evaluation of how to limit the effect bad debt can have on your business. Another way you can calculate ADA is by using the aging of accounts receivable method. With this method, you can group your outstanding accounts receivable by age (e.g., under 30 days old) and assign a percentage on how much will be collected.

Accounting teams build-in these estimated losses so they can prepare more accurate financial statements and get a better idea of important metrics, like cash flow, working capital, and net income. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in the Allowance. The allowance for doubtful accounts is a contra asset account and is subtracted from Accounts Receivable to determine the Net Realizable Value of the Accounts Receivable account on the balance sheet. In the case of the allowance for doubtful accounts, it is a contra account that is used to reduce the Controlling account, Accounts Receivable. Allowance for bad debts is a financial reserve that a company sets aside to cover potential losses from customers who may not pay their debts. It safeguards against unexpected revenue shortfalls, protects the company’s financial stability, and accurately represents financial records.